0. Getting Started

Welcome to GBank and DCM

Welcome to the family. In this course, you are going to learn many new skills, including how to efficiently use the DCM Solution. As an introduction, however, we are going to focus on learning the customer application process, and how the agent can best respond to that loan request.

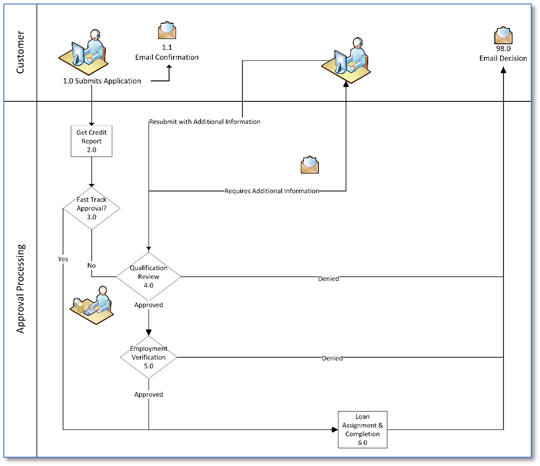

As an example, we have an Auto Loan Application for GBank. The following image shows the business process flow of the application submitted by a customer via the GBank Portal Web Page:

The Customer Application

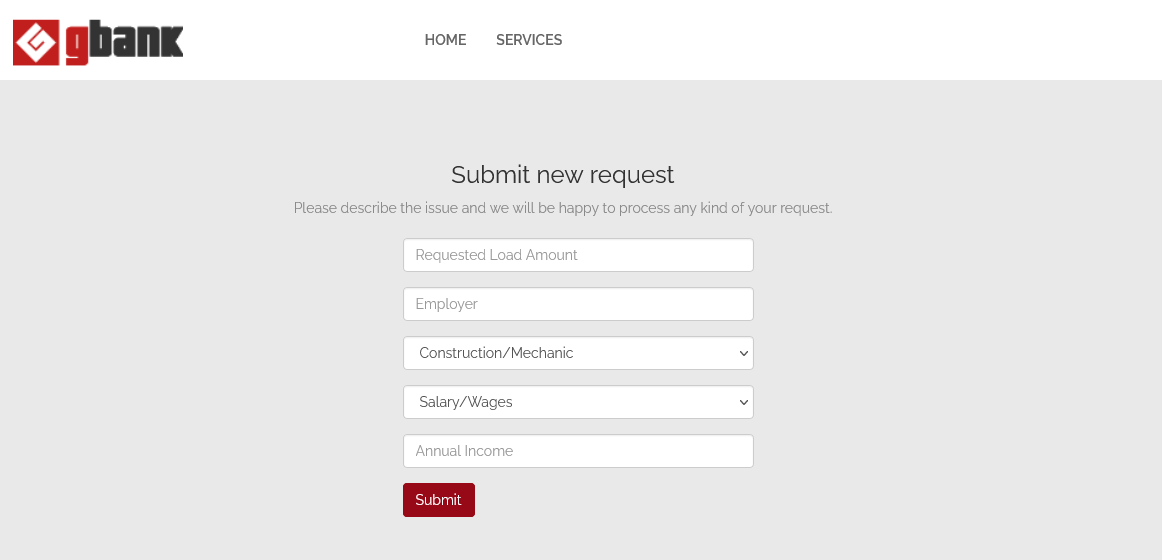

As a first step, the applicant completes the online Loan application using the GBank Web Portal to submit the loan application:

An email notification is sent immediately to the Customer confirming the receipt of their submission and provides them with a URL and password to their online application and contact information.

Meanwhile, the DCM receives the application, creates a Case record, and triggers the Loan Application workflow stopping at the Get Credit Report step.

Get Credit Report will run a background task that automatically obtains the Customer’s Credit Report. The Credit Report information is attached to a tab called “Credit Report” on the case page.

Based on the Credit Score obtained, the system determines if the loan can be automatically approved, requires additional information, or will be denied automatically.

The rule to determine the appropriate next step is:

✅ If the score value is over 720, the application is automatically approved and the Customer receives a notification via email. Then the process moves to Loan Assignment and the status of the case is changed to ‘Loan Assignment.

⭕ If the score value is between 660 and 720, the application will require additional analysis. The process moves to a step Qualification Review and the status of the case is changed to ‘Qualification Review’.

❌ If the score value is below 660, the application is denied, and the Customer receives a notification via email with the final decision. The case is closed and the status is set to ‘Denied.’

The Employment Verification consists of a task executed by the ‘Loan Officer’ who reviews the case information included in the application such as credit score, any attached documents, credit history, etc. If the Loan Officer determines that some information is missing, the process moves to Requires Additional Information.

In the Requires Additional Information step, an email is sent to the applicant requesting the specific information required to qualify for the application. The applicant will respond by providing the required information and the case information is updated. After receiving the additional information from the applicant, the case is sent to Qualification Review.

In the Qualification Review step, the bank agent will decide if the application will be approved or denied. When the application is approved, the process moves to the next step Employment Verification and the case is set to ‘Approved’ status. When the application is denied the Customer receives a notification via email with the final decision. The case is closed and the status is set to ‘Denied.’

In the Employment Verification step, the Bank Agent will be assigned the task to call the applicant to obtain verbal Employment Verification. The Employment Verification consists of filling out a form attached to the case as a tab called “Employment Verification Form.” The Employment Verification Form includes the following personal information; Social Security Number, Employer, Job Title, and Annual Salary. Based on the information provided in the Employment Verification the bank agent decides if the application is approved or denied. When the application is denied, the Customer receives a notification via email with the final decision. The case is closed and the status is set to ‘Denied.’ When the application is approved, the process moves to Loan Assignment and the status of the case is changed to ‘Loan Assignment.’

In the Loan Assignment step the customer receives the Loan Approval MS Word document via email, then the case is closed with the status ‘Approved.’

Based on the previous process description, you will analyze the information sent by the customer to identify where and how DCM could resolve the processing of an Auto Loan application.

Chapter Questions

This knowledge is essential when we begin to build the application process. Review the previous material until you can confidently answer these questions.

How many entities participate in the loan-approval process?

Name each entity participating in the loan-approval process.

Identify and list each possible case status once a loan has been requested.

What information is needed from the customer to process a loan application?

Identify and list each form of documentation needed to process a loan application.